Get approved

10 ways to sell rebills to your clients

What is a Recurring Payment?

Do you pay a subscription to Netflix, Google Apps or your website hosting?

Or maybe you make regular loan payments, pension contributions, salary payments, school fees, or corporate contributions?

Congratulations. You are one of millions who make recurring payments.

Recurring billing is simply when a merchant automatically charges a cardholder for specified goods or services on a prearranged schedule.

Today, you can even buy underwear, coffee, music, or makeup on a recurring payment basis.

Recurring transactions processed on debit and credit cards in the United States alone are expected to reach $473 billion by 2021.

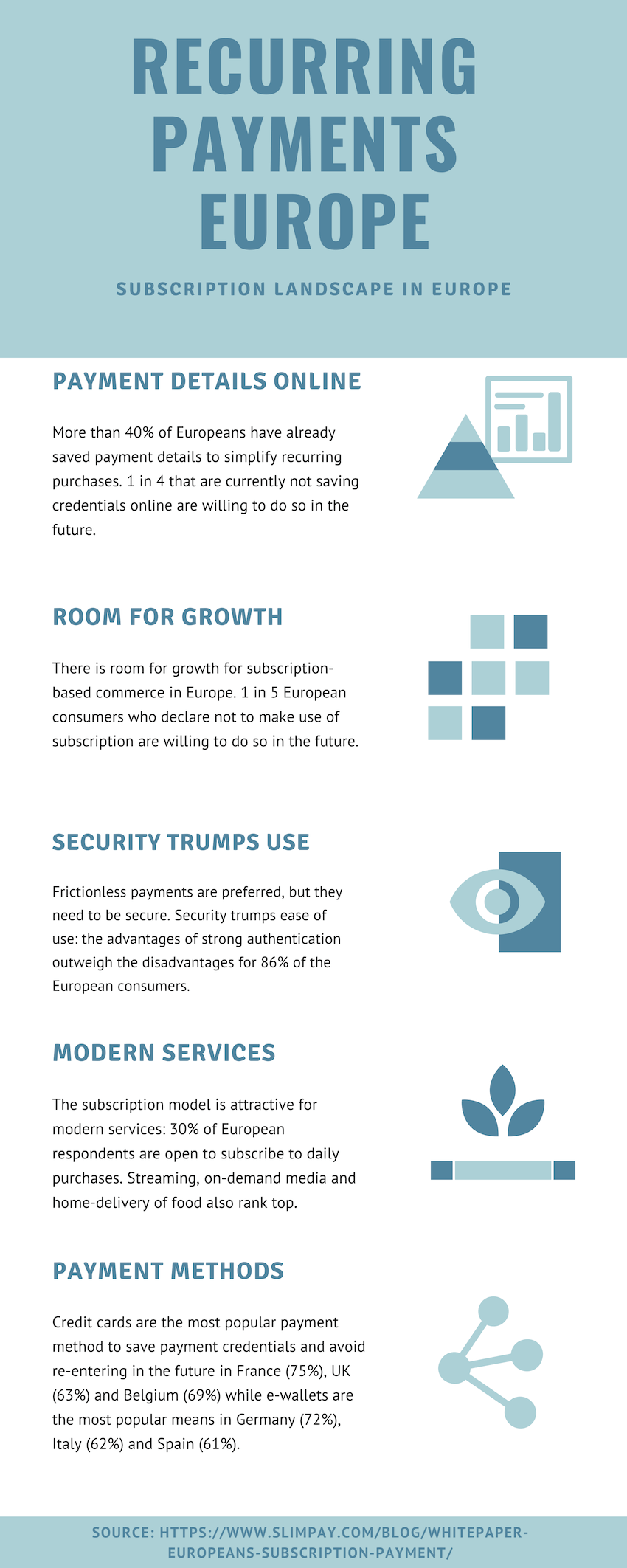

In Europe, 85% of consumers uses subscriptions, with the French and Spanish on top.

Benefits of Recurring Payments

As a business, choosing a payments processor that supports recurring payment is a no-brainer.

Recurring payments is one of the best ways to maintain a steady stream of revenue. You can more easily predict cash flow, ensure prompt payment from customers, reduce write-offs and bad checks, and enjoy increased customer loyalty.

After all, customers whose payments go out automatically (and painlessly) have more peace of mind. For a customer, the benefits of recurring payments include greater convenience, fewer late fees, environmental savings and more manageable spending. Not having to log onto our accounts every billing cycle frees us up to do more important (and more fun) things. However, the average person is quite reluctant to opt into recurring payment cycles. So how do you make recurring payments attractive to your customer?

10 ways to sell recurring billing to customers

1. Make recurring billing the standard way to purchase your product or serviceInstead of providing an option for recurring billing, make it standard.

Too many options can freeze choice, whether through confusion, inertia, or doubt. Giving the customer only one way to sign up bolsters his confidence that recurring billing is the correct way forward.

If you give people a choice between recurring vs. non-recurring, many may choose what they identify as the “safer” alternative — non-recurring billing.

2. Support as many payment types as possibleThe more payment methods you accept, the more likely you are to gain signups.

When app and website blocker Freedom got their subscriptions off the ground in 2011, the only payment options they were offering were debit and credit cards. Adding Amazon and PayPal raised their conversions by nearly 33%.

Look for a payments provider that supports the ways in which your customers want to pay. These could be Paypal, Google Wallet, Amazon Pay, Skrill, SEPA direct debit and several other domestic alternative payment methods.

3. Keep it simpleAbove all, you have to keep things simple. No one wants to read through multiple different monthly packages with confusing features and options.

Provide only provide relevant information (no marketing “fluff”) on your recurring payments option. Help your customers out by letting them know which is the most popular recurring package.

4. Create a fair price point for recurring billingPrice and benefits are the two most critical choice motivators in making a purchase.

Obviously, a lower price will help to motivate customers to go for the recurring billing option. But you don’t want to slash prices too low.

When establishing the best price point for your business, consider such factors as your:

- busines model

- costs

- competition

- value to the customer

For the UK, a monthly billing period makes sense because people tend to be paid monthly. In the U.S. most customers are paid bi-weekly.

Startup Basecamp learned that monthly billing was the best way after a struggle with annual fees. They originally went with a flat yearly fee. Here’s how they described it:

“At first we wanted to sell Basecamp with a flat yearly fee. $99/year, $149/year, $199/year. We thought it would be easier for customers to just pay once a year instead of every month. So we built the internals to support such a sales cycle.”

Eventually, they switched to monthly recurring.

“Instead of billing annually we had to switch to billing monthly. It turned out to be considerably more lucrative for us, and considerably more comfortable for our customers too. More revenue for us, lower cost of entry our customers. Instead of having to pony up $99 up front, they could pay $12/month for as long as they wanted. No contracts, no lock-in, no big initial investment on their part.”

6. Make it easier for customers to cancel at any timePeople need some reassurance that they can cancel at any time.

The cancellation button shouldn’t be hidden in some deep web page, obscure phone number or email address. Even if you make it difficult to cancel a subscription, rest assured that customers who feel trapped won’t renew when the time comes, or may even call their bank and dispute your charges.

Provide customers with the easiest possible solution to cancelling and inform them of the cancellation policy up front. Simply knowing that it’s easy to cancel often makes them more likely to give recurring billing a try.

7. Make sure your statements and process is branded and easily identifiedWhenever you send a statement or monthly reminder, make sure that you provide clear information as to the identity of your company.

MasterCard’s white paper on recurring billing provides this advice:

“It can be as simple as "Automatic Bill Pay", or a name that also incorporates your brand image. A brand name says the program is a customer benefit, not merely an accounting function.”

8. Educate your customers

Fight the fear of committing to recurring payments by telling your customers what recurring payments can do for them:

- No late fees

- It saves time

- It’s easy (set-and-forget)

- It’s safer

- Less risk of identity theft

- Less hassle (they only enter their details once)

Most people will need to be told about recurring payments several times before they sign up. Educate about your recurring payments program on all email or content marketing, invoices, and statements.

9. Explicitly inform the customer that recurring billing is in place

If you make it transparently clear that the customer will be charged monthly, then you’ll have fewer complaints, cancellations, and demands for refunds or even chargebacks.

10. Motivate with a free gift

If your customers need a nudge, give it to them. A gift, free trial or reward may be important especially if your target customers are new to recurring billing.